Best Real Estate Crowdfunding Platforms for Double-Digit Returns

Learn how to boost returns and diversify your portfolio with the best real estate crowdfunding platforms

Real estate crowdfunding still seems like one of those few undiscovered investments that most people aren’t using yet. The first real estate platforms were created less than a decade ago, but the asset only just got going in the last few years.

I started my career as a commercial real estate analyst before managing my own rental properties. I’ve been investing in real estate for more than two decades, so it’s always held a special place in my portfolio.

I’ve written about the investment a few times before on the blog but have never reviewed the top real estate crowdfunding platforms, so I wanted to share some of the sites I use to find the best real estate deals.

What is Real Estate Crowdfunding?

If you just want to know the real estate crowdfunding platforms I use to find the best deals and invest, scroll down to where I’ve reviewed 11 of the largest sites.

I feel like there are still a lot of investors though that don’t know what property crowdfunding is or aren’t taking advantage of it like they could. It’s not an entirely new concept but it’s still new enough that there are a lot of misconceptions and myths.

Real estate crowdfunding is just the social revolution catching up to old investment strategies.

A property developer or institutional investor has a property they’d like to develop but doesn’t have the funds so they apply to list their project on a crowdfunding platform. If the project goes live on the site, investors can review the details and decide whether they want to invest.

If the project is fully funded, the crowdfunding site manages all the back-and-forth payments from the developer to the investors. Projects can be funded with debt secured against the property or for an equity investment that offers the chance for higher returns.

It’s really just the same model that real estate investment trusts (REITs) and some other real estate partnerships have been using for decades but opened up to everyone.

How Does Real Estate Crowdfunding Work?

The details of how real estate crowdfunding works aren’t really any more complicated than that,

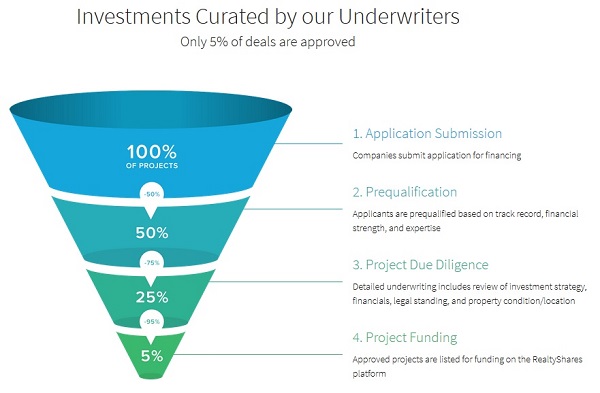

- A project owner (developer or investor) applies to list their project on the real estate crowdfunding site.

- Platform staff and investment analysts review documents on each project including background checks on the project owner, financial analysis of the project and a check on legal ownership of the property. An average of just 5% of proposed projects are approved on most platforms.

- If approved to the platform, individual investors can view project documents and ask questions. While the platform staff has verified some documents, it’s still important that you do your own analysis on the financial projections made by the developer.

- If a project meets your criteria, you can generally invest as little as $1,000 or more. Your money will be held in escrow by the platform until the project is fully funded.

- Developers receive the money when the project is fully funded or escrow amounts are returned to investors for unfunded projects. Ownership documents are written up and sent to investors.

- Depending on the length of the investment, project owners send regular updates to investors and send any cash payments through the platform. Debt investments usually pay out semi-annually while equity investments generally pay out in three to five years.

Real Estate Crowdfunding Returns

I’ve been investing and managing real estate for more than two decades and wasn’t sure if I needed a new strategy in the asset. There are two reasons why I’ve started investing in real estate crowdfunding.

First because the returns on crowdfunding properties are excellent, much higher than I’ve seen in my REIT portfolio. Second, and I’ll talk about this in the next section, because real estate crowdfunding has been a rare opportunity to diversify my property portfolio.

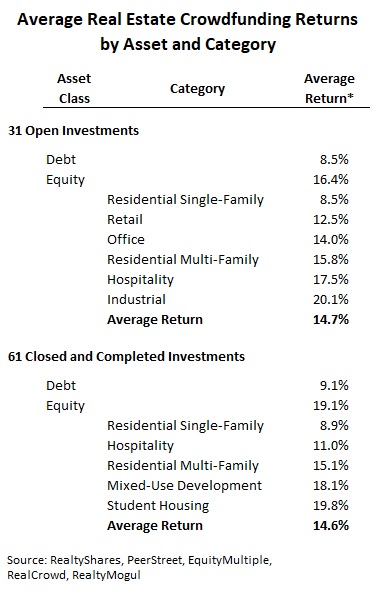

Average Real Estate Crowdfunding Platform Returns

I’ve been investing in real estate crowd deals for just under two years. Returns have been good, just under 10% on debt investments and about 15% on equity investments, but it’s really not enough years to make a call on the long-term return potential.

To get a better idea of how real estate crowdfunding returns work out over the longer-period, I surveyed the largest platforms on closed deals that have already matured. I reviewed 92 total deals, about two-thirds of which have closed and paid out so we have a good idea of what the long-term return is on the investment.

Debt investments in real estate crowdfunding have averaged a 9% return which is solid for a fixed-income and property-secured investment. Equity investments vary quite a bit depending on the property type but range from 9% to 20% for some properties. The average return on equity investments has been around 15% so it seems my results have been typical of the asset.

I’m not saying these returns will stay the same forever. None of the real estate crowdfunding platforms I surveyed had data from during or before the real estate crisis so it’s tough to say how the investments will perform during a recession.

I’m confident that crowdfunding returns, while surely lower, in a recession will still outperform stocks and (more importantly) will provide the portfolio-saving diversification every investor will need. Make sure you look through each project’s offer documents to verify the developer’s background and do your own analysis on property financials.

How to Use Real Estate Crowdfunding Investing to Diversify Your Portfolio

Besides the outstanding returns that have beaten my REIT portfolio by several percent over the past years, real estate crowdfunding is a critical piece in how I diversify my portfolio.

First, real estate itself is a diversifying asset when combined with a stock-bond portfolio. Real estate investing gives you returns comparable to stocks but a cash flow and safety you don’t get with equities. You get consistent cash flow as you would in bonds but also inflation protection and a real asset that protects your wealth when financial assets tumble.

But real estate investing for the individual investor has always been a problem.

But real estate investing for the individual investor has always been a problem.

It costs hundreds of thousands to buy one property and diversifying your property portfolio is nearly impossible without a million or more to invest. You might be able to buy a few rentals but it’s usually in one property type and in one city.

REITs have been a good opportunity to diversify into other property types and other markets, but you have absolutely no control over the portfolio. In the last decade, I’ve seen REIT managers make horrible investment decisions shifting the portfolio to retail properties and acquisitions made at market highs.

Real estate crowdfunding gives you the control to invest in individual properties but at a cost low enough that you can diversify your overall portfolio for less than $20K. You have a direct investment in the property so your money is secured against it and individual projects are much easier to follow compared to a REIT that might have hundreds of projects going at once.

Best Real Estate Crowdfunding Platforms for Investing

There are hundreds of real estate crowdfunding platforms but the vast majority get very few deals. In fact, I think we’ll see a consolidation in the coming years as smaller platforms close or are acquired by the largest sites.

A few property crowdfunding sites have already emerged as the leaders in the space and can provide you with a good selection of investments each month. Platforms have fallen into one of a few categories on the types of investments they offer.

- Equity crowdfunding platforms only publish projects that offer an equity ownership investment in the property.

- Debt crowdfunding sites only offer debt investments secured by the properties. Example: PeerStreet

- Hybrid debt and equity platforms are the most popular because investors can balance each investment type to customize their risk and return. Example: RealtyShares

- eREITs and Real Estate Funds – still some sites don’t offer direct investment in properties. Instead, the platform invests in a property and creates an LLC into which investors can pool their money. I’m actually not a big fan of this structure because you get no direct, legal ownership of the property itself.

While a few sites offer both debt and equity investments and several platforms are building a solid monthly choice of deals, I still invest across multiple platforms. It doesn’t cost anything to set up an account on a platform and you don’t even have to deposit any money until you’re ready to invest.

I aim to invest in at least 3 – 5 new properties each year to keep my pipeline filled with different property types and I like to be conservative in my selection. Setting up an account and investing across multiple platforms gives me access to as many deals as possible.

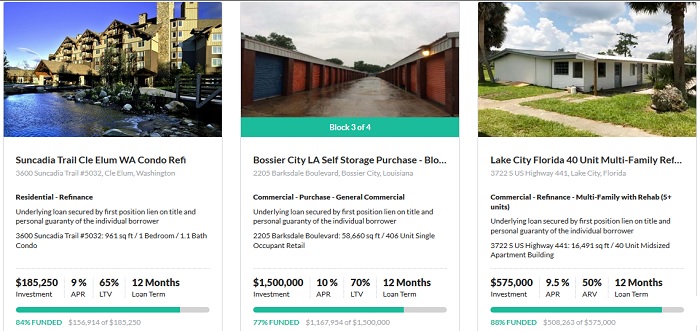

RealtyShares is one of the largest real estate crowd platforms and my go-to source when investing. The platform offers both debt and equity investments and usually has the best selection of new investments. As I write this, there are nine properties open for investment and 845 total investments to date.

What I like most about RealtyShares is that it seems to get more institutional-quality investments compared to other platforms. These are the large office buildings and multi-family properties as opposed to the single-family rentals you’ll see on a lot of sites. I already invest in single-family through my own portfolio. For real estate crowdfunding, I’m looking for large commercial properties to balance out my portfolio.

RealtyShares charges a rate spread of up to 2% on debt investments and 1% management fee on equity investments. The targeted return on most projects is between 9% to 11% annually with debt interest paid monthly or quarterly.

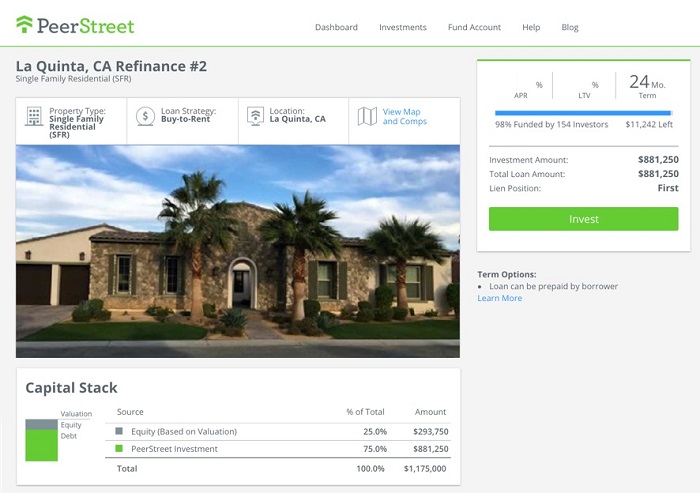

PeerStreet offers only debt investments but has a unique auto-investing tool that makes it a stress-free way to keep your money working for you. The platform gets residential, multi-family and commercial property listings and has funded more than $500 million in projects.

The average return on investments ranges from 6% to 12% with interest paid out monthly on most projects. The platform staff has unique experience in loan underwriting so there’s a little more attention to qualifying debt investments than you might find on other sites.

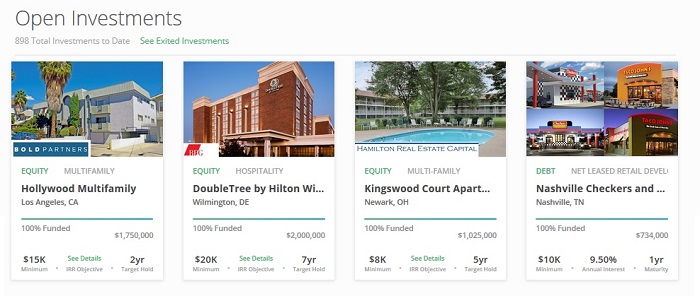

EquityMultiple is a relatively newer real estate crowdfunding platform but a good site to put on your list for high-quality commercial properties. The platform only lists institutional-quality projects so you’ll find some really nice office, hotel and retail properties to fill out your portfolio.

EquityMultiple co-invests in every deal and charges one of the lowest fees I’ve seen among crowd platforms at just 0.5% a year. It’s also the only platform backed by an established real estate company, Mission Capital, which has closed over $70 billion in real estate transactions.

Fundrise offers traditional crowdfunding investments to accredited investors but was also one of the first to start the eREIT investment structure. Investors can spread their money across different funds which charge between 0.15% to 1% a year on the portfolio.

Funds typically pay dividends quarterly but payments can vary depending on cash flow. Investment funds are based on strategy; i.e. income, growth or balanced, rather than on a specific property type.

Realty Mogul is another crowd platform specializing in the eREIT structure. Investments are through an LLC company that directly invests in different properties. Portfolio managers decide when to pay out dividends and in which properties to invest.

Fees on the platform’s eREITs range from 0.3% to 0.5% annually with dividends paid out quarterly. The platform was one of the first to launch in 2012 and it does get a good selection of institutional-quality deals.

GroundFloor is another twist on the crowd investing structure with its Limited Recourse Obligation (LRO) loan investments. Instead of investing directly in the property, you invest in these LROs that are set up for each deal. All deals are for residential real estate projects and generally charge between 1% to 2% fees annually.

Loans are typically very short-term from six- to 12-months so you’ll have to constantly re-invest your portfolio but returns are within the 10% range.

Holdfolio is a real estate platform I hadn’t heard of until just this year. The minimum investment ($20,000) is quite a bit higher than other platforms and all investments are through portfolios set up by the company.

Holdfolio buys the properties and then bundles them into a fund in which investors can invest. The portfolios are not as liquid as you will find with REITs and don’t have the maturity date you find investing in individual crowdfunding projects so you have to sell your investment back to the company to close it out.

Patch of Land is a peer-to-peer real estate platform offering debt investments backed by properties. The platform has funded nearly 1,000 loans with an average return of 11% and an average loan size of $450,000 so these are larger than the typical single-family project.

Investment fees on the platform start at 1% and loans are usually paid out monthly as principal and interest.

Prodigy Network was one of the first real estate crowdfunding sites to launch and has stayed exclusively focused on New York city properties. The platform is one of the few to only offer commercial properties and the minimum investment is typically $10,000 or higher.

Fees on projects typically start at an initial 3% for the investment then an annual management fee of 2% plus a financing fee. The platform works with real estate developers and generally takes a close interest in each project.

Real Crowd is another platform that specializes exclusively in commercial real estate projects. Where Real Crowd is unique is that it is more of a project aggregator, connecting real estate investors with investment companies rather than managing the investments themselves.

That means Real Crowd doesn’t charge fees on your investments but the investment company with which you invest will mange the projects and charge their own fees. I haven’t invested with any of the projects I’ve seen on Real Crowd yet.

I’ve only invested on a hand-full of these sites including RealtyShares, PeerStreet and EquityMultiple so make sure you do your own research into some of the other real estate crowdfunding platforms before creating an account. A few have some unique features that look interesting, but I’m not sold on some of the fees or investment structure. Real estate crowdfunding can be a great opportunity to diversify your portfolio and boost returns if you know where to look.