4 Tips for Filing Nonprofit Tax Returns With Confidence

As a nonprofit professional, you’re likely familiar with the main benefit of your organization’s 501(c)(3) status: exemption from federal income tax. Upon establishing your nonprofit, the founders filed Form 1023 with the IRS to register it as a charitable organization that would be tax-exempt for its entire existence—as long as it maintained compliance with nonprofit regulations.

One of the most important compliance tasks for your 501(c)(3) organization is filing an annual tax return via IRS Form 990. Rather than determining how much you owe to the IRS like business and individual tax forms do, nonprofit tax returns demonstrate that your organization is managing its finances correctly, which allows it to remain exempt.

If you’re new to nonprofit tax filing or have questions about it, you’ve come to the right place! In this quick guide, we’ll walk through the following four tips for preparing your organization’s tax returns:

- Know Which Version of Form 990 to File

- File State Tax Forms If Applicable

- Keep Detailed Financial Records

- Create Financial Statements Before Filing Tax Forms

With these strategies in your toolkit, filing your nonprofit’s Form 990 each year shouldn’t be too taxing. Let’s get started by breaking down some key nonprofit tax filing requirements.

1. Know Which Version of Form 990 to File

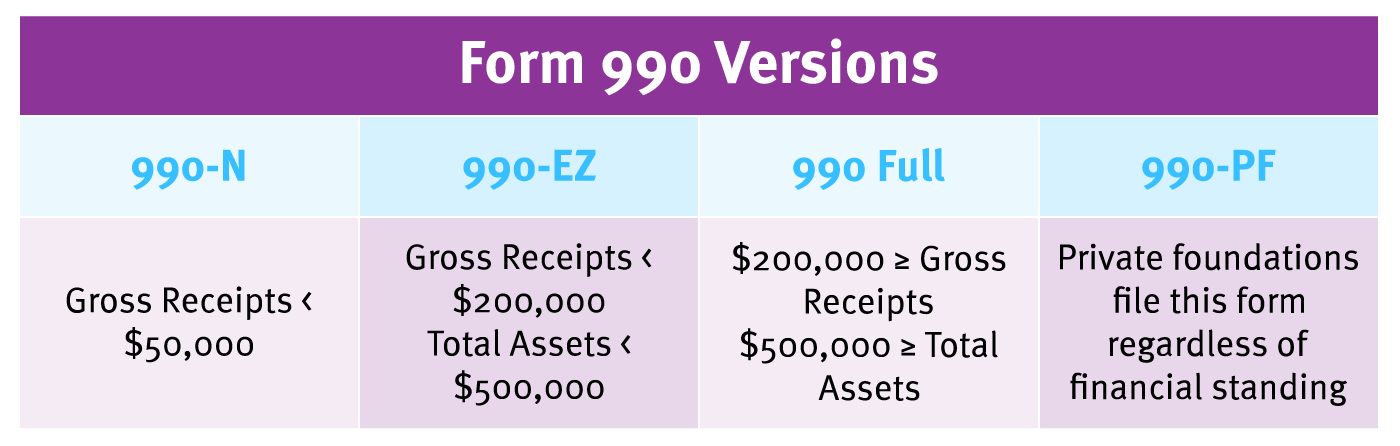

Not all nonprofits have to report the same information on their tax returns. Generally speaking, the larger your organization is, the more the IRS will want to know about your (probably more complicated) financial situation. There are four versions of Form 990, and which one your nonprofit has to file depends on its status, annual gross receipts, and valuation of total assets.

Here is an overview of the filing requirements for each type of Form 990:

- Form 990-N (eight-question digital form): Gross receipts total less than $50,000.

- Form 990-EZ (four pages): Gross receipts total less than $200,000 and total assets are worth less than $500,000.

- Full Form 990 (12 pages): Gross receipts total $200,000 or more or total assets are worth $500,000 or more.

- Form 990-PF (13 pages): All private foundations, regardless of gross receipts or total assets.

No matter which version your organization completes, the Form 990 filing deadline is the 15th day of the fifth month after your fiscal year ends (May 15 for nonprofits whose fiscal year follows the calendar year). Late submissions can incur financial penalties, and failing to file for three consecutive years risks your organization’s 501(c)(3) status, so make sure to plan ahead to get your form done on time (or file for an extension using IRS Form 8868 if necessary).

2. File State Tax Forms If Applicable

In addition to your nonprofit’s federal tax return, you might have to file additional forms with your state government, depending on where your nonprofit is registered. The requirements for maintaining state-level tax-exempt status vary widely—for example:

- New York requires nonprofits to complete a separate annual filing via Form CHAR500.

- Georgia requests that nonprofits submit a copy of their Form 990 to the state government each year but doesn’t have a separate state tax return.

- Montana only asks for a copy of each nonprofit’s annual report in order for it to remain exempt.

The IRS website links out to the nonprofit tax filing requirements for each state, so remember to check it each year to stay up to date on any changes.

3. Keep Detailed Financial Records

Effective financial recordkeeping is critical for completing both federal and state tax returns accurately. More than simply filing the required forms correctly and on time, your nonprofit’s tax-exempt status hinges on whether you can show that you’ve reinvested all of your revenue back into your organization and allocated it toward activities that further your mission.

Here are some ways to improve your organization’s financial recordkeeping:

- Use dedicated accounting software. Many nonprofits start out tracking their transactions in a spreadsheet, which is useful when your organization is still small. However, once your financial situation becomes more complex, you should transition to an accounting platform that makes it easier to track payables, receivables, fixed assets, and other advanced functions. Plus, with many of these solutions, you can easily store all financial documentation in one place.

- Practice good data hygiene. As NPOInfo’s nonprofit data hygiene guide explains, regularly ensuring your nonprofit’s data storage systems are free of inconsistencies, duplications and gaps in information is critical for effective decision-making and reporting. While many organizations only think of data hygiene in the context of their supporter database, the general principles also apply to your accounting software.

- Enlist professional help. If your nonprofit bookkeeping needs start to outgrow your existing team’s capacity, consider bringing on an in-house bookkeeper or leveraging outsourced bookkeeping services to ensure consistent, accurate financial data entry. Your bookkeeper can also manage invoices, write checks, process payroll, and take care of many other everyday financial tasks that you’ll report on your Form 990.

In addition to a bookkeeper, you might work with a nonprofit accountant to analyze your recorded financial data and fix any mistakes before they find their way into your tax returns. Plus, you can have your accountant complete your tax forms for you!

4. Create Financial Statements Before Filing Tax Forms

Your nonprofit’s financial statements—the four reports that your organization should compile annually to organize and summarize its financial data—are a key reference for filling out your tax returns. They structure information similarly to Form 990, so having these statements on hand makes it easy to report your financial data exactly as the IRS requires.

According to Jitasa’s guide to nonprofit financial statements, the information included in each of the four reports is as follows:

- Statement of activities: Revenue, expenses, annual change in net assets

- Statement of financial position: Assets, liabilities, net assets

- Statement of cash flows: Cash movement from operating, investing, and financing activities

- Statement of functional expenses: Annual expenditures categorized by purpose (program, administrative, or fundraising)

Besides being useful for tax filing purposes, your financial statements should inform other essential processes at your organization, such as budgeting and strategic planning. As soon as your books are finalized for the year, pull the reports so you can reference them for these activities and have them ready to complete your tax forms well before their deadlines.

Properly filing your nonprofit’s tax returns is critical for maintaining compliance and demonstrating effective financial management. As you implement the tips above to strengthen your tax filing process, you’ll boost your overall accounting performance, leading to more effective decision-making and resource use at your organization.